Maybe the Financials are making a turn....Finally. And they should bring the entire market along for the ride. BAC came out with relatively great earnings this morning (Monday, July 23) and its stock price is off to the races, showing over $31 in early trading, up from $27.

Jeff and I talked about buying more call contracts on Citibank on at our weekly coffee on Saturday. Take a look at the January 2010s, strike price at $30 for $1 a contract. This is looking like an even better move as of today. Citibank is back to $20, up from a low of $14 last Tuesday (July 15). BAC had gone from $40 to as low as $18.44 in the past ten weeks. And now the open for BAC looks very good, as mentioned. It might pay to wait until Tuesday afternoon or Wednesday morning to make this move, or use limit pricing to not overpay.

I understand that WM, Wachovia and Countrywide report tomorrow. Those have been the weaker of the banks as they are heavily involved in the mortgage industry (Wachovia had bought at the top in 2006, Golden West, a California lender with heavy sub-prime and Alt - A exposure). It is unlikely they will have good news to report and will probably pull the financials back down tomorrow (Tuesday), though even "not so bad" news may be greeted with a pop in the stock price.

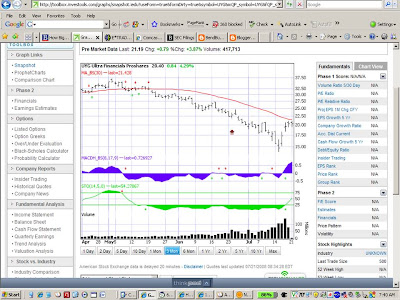

I have started using Investools to time my trades in my short term trading account. Their basic technical signals work very well both for buying and selling. Had I been following this system earlier, it would have gotten me out of the volatile Financials at all the right times, such as May 8 on the latest downturn. At that time, C was at (24.50), BAC (38.50) and UYG (32.50). The Investools chart on UYG shows it just now again reaching the buy signal (MACD, Stochastics and Moving Average all turning green). This was last given on April 23 and before that on March 23, just after the infamous Bear Stearns bottom on May 19.

In order to capture this uptrend, I am selling short the puts on UYG, which is the leveraged XLF Financial Index fund. I will do so with a tight stop to the downside. UYG is a good way to play the financials to diversify the risk in that sector. There may still be individiual bank blowups. But as the market bids up the price of the fincancial group stocks, their capital base expands accordingly, putting less pressure on their coverage ratios.

This buys time to liquidate their commercial paper portfolios at decent prices. They don't have to dump them at losing prices, or lose the entire portfolio to bankruptcy (Indymac) or a takeover (BSC). We are convinced that the banks' commercial paper portfolios are worth a lot more than their current artificially low valuations (based on the mark-to-market requirement of GAAP reporting). When the paper is properly valued and sold, the banks will be able to show a lot more capital on their books than they are now credited with.

It may not be over for the Financials, so we will keep a close watch on UYG and other financial stocks.

Monday, July 21, 2008

Buy UYG - Financials have made a turn

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment