I recently attended a trade show in Houston for the Radiological Therapy industry. I was able to visit the booth of Still River Systems which has developed a unique, compact and relatively inexpensive Proton Beam Radiation Therapy tool. Still River Systems is still a privately held startup company. But some of its shares are owned by partner American Shared Hospital Systems (AMS).

AMS is a stock I have owned for a little over a year. It is a very small cap stock (around $12M total capital). There are 5M shares outstanding with a stock price today of $2.40. The stock is very thinly traded and bounces quite a bit as a result. A couple weeks ago it was less than $2. Last year it was over $6 while it was still issuing dividends at a yield over 6%, so was popular as an income vehicle.

But the middle of last year, AMS decided to drastically reduce its dividend and instead use its cash to make investments (which cratered its stock price). One of those investments is an ownership position in Still River Systems, more of which I will discuss shortly. but first more on AMS as it stands today, without the prospect of Still River being a home run investment.

AMS has cash and other net (shareholder's) equity on its books of almost $20M. With 5M shares, this means the tangible book value is $4/share. The stock is trading at about 50% of tangible book value! And this with a very good cash flow profile. AMS reported earnings on Tuesday and it reported: "Cash flow, as measured by earnings before interest, taxes, depreciation and amortization, increased to $2,657,000 for this year's second quarter and $5,025,000 for this year's first half, compared to EBITDA of $2,381,000 and $4,634,000 for the second quarter and first six months of 2007, respectively."

So, cash flow to stock price is almost a 1 multiple ($12M (P) to $10M (CF)): absolutely unheard of. 4 or 5 is a screaming buy. The cash flow is well secured as this is a long term lease business to a very good customer base of large hospitals. And again, Still River Systems, which apparently AMS continues to buy into, is not even reflected in these figures.

So, what is Still River Systems: I would refer you to their website for more information: www.stillriversystems.com. But I did meet one of the directors on Monday morning and he was guarded (as he should be at a show) but still enthusiastic. He somewhat discretely congratulated me for buying AMS as a way to buy into Still Rivers' future. They are going into the final stages of FDA "marketing approval" and expect to have equipment to market in mid-2009. AMS is purchasing, managing and installing their test systems (2 are installed and have been for some time). The results have all been very positive. Here is an article from late 2006 on the advatanges of compact PBRT technology. It is a bit dated, but still valid: http://medicalphysicsweb.org/cws/article/industry/25886

As the article comments, the low installed cost of the Still River Systems equipment is the key to its future success. They have developed a novel new way to deliver protons to cancer victims for therapy. The low cost of the systems will allow them to be deployed much more widely to hospitals and therapy centers. It should also permit Medicare reimbursement for the procedure which will open up a large new customer base. AMS, as a part owner, will control the distribution of those systems, which it does not now with the Leksell "Gamma Knife" systems it currently buys and leases. So, it is a double win: Still River Systems has a well funded partner with industry connections in AMS to rapidly expand its sales; while AMS should get preferential treatment and a share of the profit on every Still River System it buys and installs. Hard to beat this combo.

I can't offer any solid projections based on what I now know, only speculation, but this could easily be a 10 or 20 banger within the next 5-10 years (stock price of $20-40 / share based on $200M revenue / $50M cash flow).

Thursday, July 31, 2008

AMS And Still River Systems

Thursday, July 24, 2008

Another Opinion on the Rotation from Commodities to Financial (soft) Equities

Just picked this up off the E-Trade News. The article from this PM confirms the points I have made recently regarding a rotation from the commodities to the financial equities. It sure is nice to see someone independently come up with the same technical indicators that I have identified ;o) The rotation may not be long term in nature, but it sure looks tradeable over the next few months (today's action notwithstanding).

The chart below compares the Financials index, XLF with the oil index, OIL. The relationship between the two is almost perfectly inverse the past month. So, as oil and commodities decline, financials and other related equities will increase. This makes sense because oil / commodities are a reflection of inflation denominated in the home currency. Higher inflation must mean higher interest rates, which must damage financial equities.

"Goodbye commodities, hello financials" 1:01 PM ET 7/24/08 Marketwatch

NEW YORK (MPTrader) -- It seemed as though there was no place to hide when Apple and the technology sector, along with Bank of America and the financials, got clobbered with the rest of the market at Tuesday's open. Though by mid-day, the market did recover in a big way and left behind another significant low within a "rolling bottoming process."

Tuesday's action in the Standard & Poor's 500 Index (SPX) established a low of 1248 and high of 1277. That dwarfed Monday's daily range, closing well above Monday's close and high, so from a strict technical prospective the blue chip index had a key upside reversal.

In addition, unlike the rally off of last week's July 15 low, Tuesday's rally did not have the feel of a temporary oversold rally. The morning sell-off wasn't as dramatic, with the S&P 500 only down 11.5 points from its previous close as opposed to nearly 28 points on July 15. So it was a higher, secondary low -- more corrective looking than that of the previous week, and less susceptible to a mere reactive bounce.

Driving the S&P 500, which has now recovered 6.8% from its July 15 low (through Wednesday's close at 1282), are the financials, which have room to go higher. Over the last several months the percentage that the financials make up of the S&P 500 has diminished just by virtue of the price deterioration, while the energy sector percentage of the index has increased. But institutions in the last week, in particular, appear to have begun to shift their money out of the once high-flying energy sector into equities.

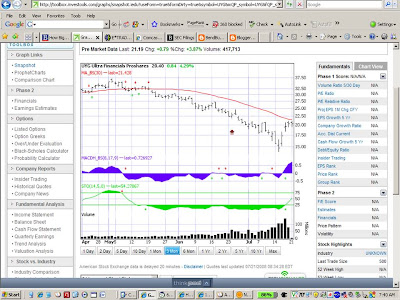

One way to play this trend is through the Financial Select SPDR (XLF) or its sister ETF, the Ultra Financials ProShares (UYG), which moves two times that of the XLF. Since its low of 14.08 on July 15, the UYG is up 68% through Wednesday's close at 23.67.

Traders should look this week for a break of 26.40. That's where the major resistance trendline from Sept. 30 of last year cuts across the price axis, a break of which would be the first major signal of damage to the downtrend that's transpired since the fourth quarter of last year. Beyond that, if the UYG can sustain above 33.75, it would indicate the end of the bear market in financials.

Likewise, the Ultra Short Oil & Gas ProShares (DUG) provides an opportunity to play the downside move in energy shares. The DUG has put in a rounded bottom at around 25.30, closing Wednesday at 36.16, up 42% from its low, as oil prices have declined 15% from their $148 high. Its chart points to 39.50-41.00 next.

Another way to play the trend is through the iShares Dow Jones Transportation Average (IYT), which for obvious reasons is getting a major lift from declining energy prices. The IYT chart shows it made its bear market, corrective low on January 6 at 72.86, and went to new highs after that at 99.09 on May 18. The July 15 low at just under 82 was the pullback low after that new high, and from there it's gone to just above 92 as of Wednesday's close, a 12% gain in just a week. Tuesday was the first time it closed above its 50-day moving average since the first week of June, suggesting the IYT is in a new upleg and heading directly back to 99 to test that high.

Other commodity indexes are confirming what the IYT is suggesting, like the PowerShares DB Agriculture ETF (DBA), which closed below its 200-day moving average for the first time in a year on Tuesday. The PowerShares Commodity Index Tracking Fund (DBC) closed for the second day in a row below its 50-day moving average and looks like it has considerable room to go down as well.

In addition, the streetTRACKS Gold Shares (GLD) looked like it was on its way to retest high levels at around 98 early Tuesday but instead ran out of gas at around 96.20 in the pre-market hours and then reversed in a big way and closed at 93, falling to 90.57 as of Wednesday's close. Chances are the GLD now will move back to below 90, and possibly towards a full-fledged test of its rising 200-DMA, now at 86.80, which must contain any further sustained weakness to avert a total breakdown in gold prices towards $800 ($80 in the GLD).

The financials, transports and stock index ETFs are turning up, while we have sell signals in the, energy, agricultural and precious metals sectors. For people who have followed markets for a long time, this inverse relationship between equities and commodities makes intuitive sense and suggests there are trading opportunities developing that will last longer than a few hours!"

Mike Paulenoff is author of MPTrader.com, a diary of his intraday technical chart analysis and trading alerts on ETFs for gold, oil, equity indexes and other major markets. (mptrader.com)

Wednesday, July 23, 2008

Bank Stocks continue to Strengthen

Today the banks are continuing to look better on the charts. The earnings reports have been good for some and poor for others, but nothing substantially below expectations. It is the actual vs. expectations that drives the market, not the absolute performance.

Following my charts, I see that all of the worst banks are now showing a positive breakout. UYG (double of the XLF index) made the buy signal a couple days ago. And now I see that FRE, FNM and WM are also showing a positive breakout. C and BAC made their breakout on Monday afternoon. Because they went down so far the past eight weeks, the banks can bounce quite a bit before they hit resistance levels from mid-May. For example, the first point of resistance on UYG is around 26. If it breakes through that, which should be easy enough, it will face significant resistance around 35 where it was through late April into mid-May.

But I am using a August 25 Strike sold put to capture the first leg of this move, with UYG at 21. It had a $4.20 premium on Monday. Now that is down to $3.20 as of the close yesterday and showing an even lower open today. So, already, I have captured more than 25% of the premium available. On 20 contracts, that is over $2000. This is a bolder play than normal, for me, but I feel strongly about the bounce in banks, though am suspicious of another leg down. So, I will be out of the banks by the time UYG gets to 26. I had a scare on Tuesday morning when the banks cratered at the open on bad earnings from Amex and Wachovia and UYG dropped to 19.13. Options on a levered index make for an exciting ride!

Tuesday, July 22, 2008

Bad Open on July 22

Wow…didn’t take long for more bad news to hit the stock market.

Merck and Pfizer and other big pharmas are getting killed today and in after-hours. Merck is down to $33 from $37 just a couple days ago. Glad I am out of Merck and Pfizer.

Apple is also getting beat up. Bad earnings report and disappointing I-Phone sales (just a few days after the launch of the new 3G version was declared a major success). There is also a story about Steve Jobs being sick. But this just shows how neurotic the market has become.

Financials were looking better and then, wham!, along comes American Express’s Q2 report and depresses the whole market. The good pop on UYG and XLF this morning were all but gone by the end of the session and are well below their closes in after-hours.

So, if the market continues to act grumpily in the morning, I will be selling forward my recently acquired (this morning) UYG August sold puts to September at the same strike of 25. This will get me a little more premium and also more time. It should not be too hard for the Financials to get back the 25 strike when the market decides to be happy again, as it was there as recently as early June. The BAC and C quarterly reports showed clearly that unless there is another big bomb in the Financials, that the market should start repairing itself. C and BAC look good as does JP Morgan and Goldman. Freddie and Fannie have been backstopped, so no real danger there. I don’t think Obama or McCain will get tough on government bailouts. Obama would be very favorable to bailouts as a large government Democrat. And affordable housing for the middle class is sacred to Democrats, so politically, Financials should do well as the elections approach.

Jeff, you must be happy the market is finally looking kindly at Valero. Funny how a little story in Barrons makes such a big difference.

Monday, July 21, 2008

Buy UYG - Financials have made a turn

Maybe the Financials are making a turn....Finally. And they should bring the entire market along for the ride. BAC came out with relatively great earnings this morning (Monday, July 23) and its stock price is off to the races, showing over $31 in early trading, up from $27.

Jeff and I talked about buying more call contracts on Citibank on at our weekly coffee on Saturday. Take a look at the January 2010s, strike price at $30 for $1 a contract. This is looking like an even better move as of today. Citibank is back to $20, up from a low of $14 last Tuesday (July 15). BAC had gone from $40 to as low as $18.44 in the past ten weeks. And now the open for BAC looks very good, as mentioned. It might pay to wait until Tuesday afternoon or Wednesday morning to make this move, or use limit pricing to not overpay.

I understand that WM, Wachovia and Countrywide report tomorrow. Those have been the weaker of the banks as they are heavily involved in the mortgage industry (Wachovia had bought at the top in 2006, Golden West, a California lender with heavy sub-prime and Alt - A exposure). It is unlikely they will have good news to report and will probably pull the financials back down tomorrow (Tuesday), though even "not so bad" news may be greeted with a pop in the stock price.

I have started using Investools to time my trades in my short term trading account. Their basic technical signals work very well both for buying and selling. Had I been following this system earlier, it would have gotten me out of the volatile Financials at all the right times, such as May 8 on the latest downturn. At that time, C was at (24.50), BAC (38.50) and UYG (32.50). The Investools chart on UYG shows it just now again reaching the buy signal (MACD, Stochastics and Moving Average all turning green). This was last given on April 23 and before that on March 23, just after the infamous Bear Stearns bottom on May 19.

In order to capture this uptrend, I am selling short the puts on UYG, which is the leveraged XLF Financial Index fund. I will do so with a tight stop to the downside. UYG is a good way to play the financials to diversify the risk in that sector. There may still be individiual bank blowups. But as the market bids up the price of the fincancial group stocks, their capital base expands accordingly, putting less pressure on their coverage ratios.

This buys time to liquidate their commercial paper portfolios at decent prices. They don't have to dump them at losing prices, or lose the entire portfolio to bankruptcy (Indymac) or a takeover (BSC). We are convinced that the banks' commercial paper portfolios are worth a lot more than their current artificially low valuations (based on the mark-to-market requirement of GAAP reporting). When the paper is properly valued and sold, the banks will be able to show a lot more capital on their books than they are now credited with.

It may not be over for the Financials, so we will keep a close watch on UYG and other financial stocks.

Saturday, July 19, 2008

Fannie and Freddie: Does America owe every citizen a Home?

I am posting an intersting editorial from this week’s Barrons. It makes many good points and questions the concept of Freddie and Fannie. I think the editor’s line of thinking will be echoed by many and may cause a monumental change in the mortgage markets in America. At the least it will cause a great debate: does America owe easy mortgages to all citizens, regardless of their ability or interest in repaying their debts?

Cbass will be proud of this piece:

“Is This Capitalism?

Thomas Dolan - Barrons Editorial Staff

EVERY ONCE IN A WHILE, THE MARKETS serve up new evidence that a lot of investors don’t really care what happens to their money. The past two weeks have been awash in proof. Just look at the recent declines in share prices for the stock of Freddie Mac and Fannie Mae (Feddie) on “news” that the two mortgage behemoths may face large losses and may have to raise more capital to make good their guarantees.

To whom did this come as a surprise? Who was stunned by this news? Who had held firm during the past year, while Fannie’s and Freddie’s stock fell 80%, and indeed the whole financial sector took a haircut that reached all the way to the belt?

Was this “capitulation,” when the last stubborn bulls give up? Was it bottom-fishing by people whose lines were too short? Or was it a rude awakening of people who have been sleepwalking in the Street?

Investors’ eyes were closed to so many things:

For years, F&F could not even issue clean financial reports. For years before that, F&F issued financial reports that sophisticated investors questioned, loudly and publicly. For decades, F&F ran on thin margins of capital, creating leverage that would shame an insolvent savings and loan — or the federal government. For years, Fannie was operated by overpaid Democratic political operatives (Freddie made its political accommodations more discreetly).

Yet people who considered themselves risk-averse bought stacks of F&F paper as higher-yielding substitutes for “risk free” Treasuries. They thought that Fannie and Freddie are backed by the federal government — even though the government always shrank from saying so explicitly.

Myth Becomes Reality

Regrettably, some of the naive investors were right. Fannie and Freddie — henceforth to be known as Feddie — are backed by the federal government. The Treasury, the Federal Reserve, the Congress and the White House have tuned up and now sing in chorus, declaring that Feddie is indeed the ultimate example of “too big to fail.” They will buy Feddie stock, lend to it from the Treasury or the discount window of the Fed. They will do whatever else it takes to be sure that holders of Feddie-guaranteed mortgages don’t lose their money.

Officialdom still shrinks from a straightforward declaration of unconditional support for Feddie or a straightforward nationalization, because it hopes to muddle through this crisis without adding $5 trillion or so of mortgages and guarantees to the national debt.

Fannie and Freddie and the whole mortgage mess represent capitalism at its worst — the Invisible Hand in the taxpayer’s pocket. First, it pays out bonuses and benefits to politically connected big shots. Then, it takes money from some citizens to redress the bad investments of others. It’s the classic “mixed economy,” in which rewards are private and risks are socialized.

As an economic adage tells us, “Capitalism is the exploitation of man by man; with socialism it’s the other way around.”

The Blame Game

We are hoping that regulators find a way to go back and strip the former executives of Fannie and Freddie of all their ill-gotten bonuses, but we also blame the game as much as the people who played it.

That game was created by those who believed that political advantage lay on the side of cheap credit, especially cheap credit for houses. They were right, of course, but they extended the idea much too far. Among their serious mistakes:

• Permitting F&F to “guarantee” timely payment of principal and interest without requiring them to have adequate financial resources.

• Allowing F&F to hold mortgages in their own portfolios, like banks, only with inadequate capital.

• Letting F&F sell stock to the public with a wink, signaling that the federal government would never let them fail.

• Encouraging banks and mortgage brokers to travel a path well-marked by F&F, using easy credit to foster subprime loans, Alt-A loans and liar loans, all with associated high fees, passing them on to investors lulled into a false sense of security by F&F and their market power.

As so often happens in American financial crises, these failures are not failures of capitalism, but instead failures of a phony regulatory system that assures people that their speculations are sound investments.

What Is This?

The famously prescient investor Jim Rogers, who took his money and his family out of the U.S. economy and out of the U.S. entirely, raised some good points last week:

“I don’t know where these guys get the audacity to take taxpayer money and buy stock in Fannie Mae. I mean, what is this? What are they doing guaranteeing their debt? The people who bought debt in Fannie Mae and Freddie Mac can read a prospectus. It says it is not guaranteed by the government. Anybody who can read a balance sheet knew that both of those companies were a sham and they had problems. Now, we have to bail out the Japanese? The Japanese own hundreds of millions of dollars of this stuff and so we are going to bail out the Japanese and the Chinese and everybody else in the world? What is this? It ruins the Federal Reserve’s balance sheet, it makes the dollar more vulnerable, and it increases inflation, and it drives down the dollar.”

A good question: What is this? A panic, surely, but not so much a financial panic as a governmental one.

The federal chorus stands behind Feddie like a midnight choir standing behind the chief drunk. The lady of the house comes out to see what’s going on, and the choir denies all responsibility. Anyway, he will be sober in the morning, they promise.

That’s what they said the last time, and the time before that and the time before that. Using the money of its innocent citizens, the government is trying to prop up Feddie until it can stand on its own again, attract capital again, pour money into the mortgage market again, raise the price of housing again, and, of course, collapse again — perhaps not taking the banking system with it.

Fannie and Freddie are not too big to fail, but there’s a bigger question: What about the federal government itself?”